In most cases, no, you cannot lose your house due to an at-fault car accident in Florida, This is thanks to the Homestead Exemption and the No-Fault Auto Insurance Law.

The Homestead Exemption protects your primary home from creditors, including accident victims. This protection, however, only applies to your primary residence and does not extend to second homes or rental properties.

Through the No-Fault Law, PIP insurance is required. If your personal injury protection (PIP) coverage doesn’t fully cover medical expenses, or if you don’t have enough liability coverage, you may be personally liable for the remaining costs, putting your assets at risk.

According to the Insurance Research Council, in 2020, the average annual cost for auto insurance was $1,342 in Florida, more than 30 percent higher than the countrywide figure. Due to high costs, it is vital to understand the limitations of your insurance coverage to avoid further expenditure and loss.

At Injury Law Pros, we focus on helping clients protect their assets, working on a contingency fee basis—you don’t pay unless we win.

Key Takeaways

- Florida’s No-Fault Auto Insurance Law and Homestead Exemption generally protect your home from being seized after an at-fault accident.

- Personal Injury Protection (PIP) covers medical expenses and lost wages, but it doesn’t cover property damage or injuries to others.

- Bodily Injury Liability (BIL) insurance protects your assets if you cause injuries to others and are sued for damages.

- Without enough insurance, your other assets—like savings or future earnings—could be at risk in a severe accident.

Understanding Florida’s No-Fault Auto Insurance Laws

Many drivers assume auto insurance works the same in every state, but Florida’s no-fault system has unique rules that impact how claims are handled. Understanding these laws can help you to better handle insurance requirements and avoid unexpected complications after an accident.

What Is Florida’s No-Fault Insurance Law?

Florida’s No-Fault Auto Insurance Law requires drivers to carry Personal Injury Protection (PIP) insurance, which covers medical expenses and lost wages, regardless of who caused the accident.

As per data from PolicyGenius, Florida is one of only 12 states with a no-fault system, meaning that insurance companies cover their own policyholders’ medical expenses up to the policy limits.

How Does Florida’s No-Fault Insurance Law Work?

Under the no-fault system, each driver’s own insurance pays for their medical bills and lost wages up to a set limit, regardless of whether they were at fault in the accident. This system aims to reduce lawsuits and expedite the compensation process for accident victims.

What Does the No-Fault Insurance Law Cover and Exclude?

While PIP insurance covers your medical costs, it does not cover property damage, pain and suffering, or injuries that exceed the severity threshold set by Florida law. If injuries surpass this threshold, the injured party may pursue a lawsuit against the at-fault driver for additional damages.

Can You Be Sued in Florida If You’re At Fault?

If injuries surpass a certain severity threshold, the at-fault party can still be sued for additional damages.

What Does Florida’s Severity Threshold Mean?

Florida’s severity threshold requires that the injuries be serious enough to justify a lawsuit. If the injury meets one of these criteria, the injured party can sue the at-fault driver for damages not covered by their PIP insurance. This threshold can include:

- Permanent disfigurement or scarring

- Permanent injury (such as a disability)

- Death

What Is Personal Injury Protection (PIP) Insurance in Florida?

Personal Injury Protection (PIP) is a mandatory insurance coverage in Florida that helps pay for medical expenses and lost wages if you’re injured in a car accident, regardless of who is at fault.

This part of Florida’s no-fault insurance system makes sure that drivers have immediate access to essential coverage without the need for lawsuits or proving fault.

What Does PIP Insurance Cover in Florida?

PIP covers:

- 80% of medical expenses for injuries sustained in an accident.

- 60% of lost wages if the injuries prevent you from working.

- Death benefits of up to $5,000 for surviving family members in the event of fatal injuries.

What Does PIP Not Cover?

PIP doesn’t cover property damage or injuries to others. According to the Insurance Information Institute in 2023, 14% of drivers were uninsured, which often leaves them exposed in case of severe accidents. This is why understanding the limitations of PIP is vital—if you’re at fault and don’t have enough coverage, your assets could be at risk.

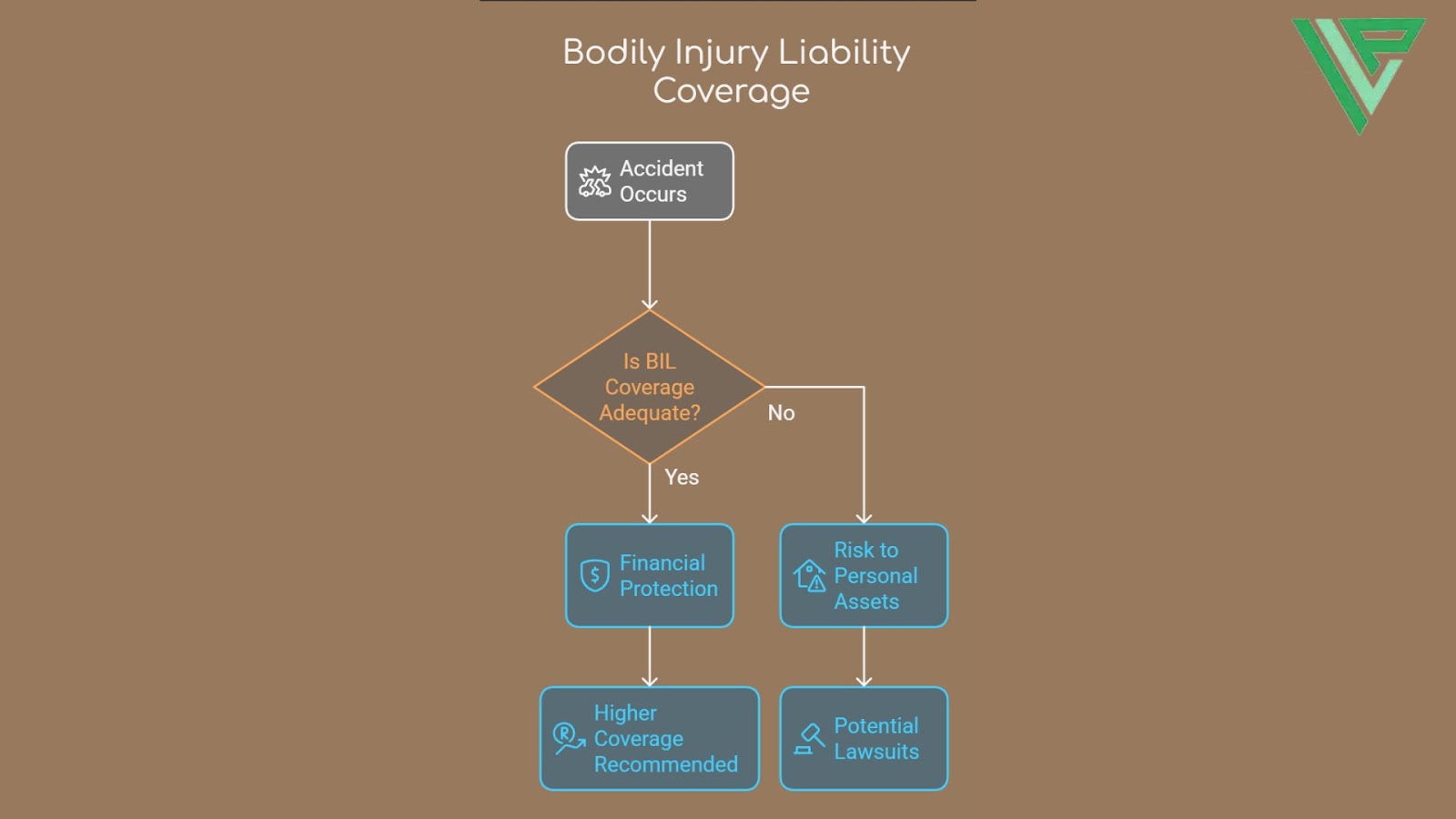

The Role of Bodily Injury Liability Coverage in Protecting Your Assets

Bodily Injury Liability (BIL) coverage is an important part of your car insurance in Florida, particularly if you are found to be at fault in an accident. This coverage protects your assets, including your savings and future income, by covering the medical costs and other expenses of the injured party.

Without it, you’d be directly responsible for these costs, putting your assets at risk.

What Does Bodily Injury Liability Coverage Include?

BIL insurance helps pay for:

- Medical expenses of the injured party.

- Lost wages due to their inability to work.

- Legal costs if the injured party sues for additional damages.

Why Is Bodily Injury Liability Important?

This coverage protects you if you’re at fault in a car accident and the other party suffers bodily harm. It’s your financial shield, covering the injured person’s medical expenses, loss of income, and even legal fees if they sue.

How Much Bodily Injury Liability Coverage Should You Have?

The minimum and recommended BIL coverage is:

- Minimum required coverage in Florida: $10,000 per person and $20,000 per accident.

- Recommended coverage: Higher limits, such as $100,000 per person and $300,000 per accident, can better protect your assets in case of a serious injury.

How the Homestead Exemption Protects Your Primary Residence

In Florida, a legal framework called the Homestead Exemption, protects your primary residence from creditors.

What Is the Homestead Exemption?

This law prevents the forced sale of your home to pay off creditors, including accident victims. However, it doesn’t cover all scenarios. It applies only if you’re the property’s sole owner and you reside there permanently. It’s your first line of defense in accident liability.

What Properties Are Not Protected by the Homestead Exemption?

It won’t protect second homes or rental properties. Understanding this exemption can provide peace of mind, but remember, it doesn’t replace the need for adequate car insurance.

Frequently Asked Questions

What Other Assets Could Be at Risk After an At-Fault Accident in Florida?

In Florida, besides your house, other assets like your car, savings, and potentially future earnings could be at risk after an at-fault accident.

How Can I Protect My Assets From Being Seized After an At-Fault Accident?

To protect your assets after an at-fault accident, you’d need sufficient auto insurance coverage. Consider a liability policy with high limits or an umbrella policy for extra protection. Consult an attorney for personalized advice.

Does Filing for Bankruptcy Provide Any Protection Against Asset Seizure in Florida?

Yes, filing for bankruptcy can offer protection against asset seizure in Florida. It’s not a step to take lightly, though. You’ll need to evaluate your situation carefully and consider all possible consequences.

How Does an At-Fault Accident Impact My Car Insurance Rates in Florida?

Yes, an at-fault accident can impact your car insurance rates in Florida. Insurers often raise premiums after accidents, as you’re seen as a higher risk. It’s best to compare quotes after an accident to save money.

Can My Wages Be Garnished to Cover Damages After an At-Fault Car Accident in Florida?

Yes, your wages can be garnished in Florida if you’re at fault in a car accident. It’s dependent on the damages exceeding your insurance coverage. It’s essential to carry sufficient insurance to protect yourself financially.

Get the Help You Deserve Today

If you’re worried about your assets being at risk after an accident, Injury Law Pros is here to help. With our contingency fee basis, you only pay if we win, and we work hard to make sure you keep more of your settlement by negotiating down medical bills.

If you’re unsure about your insurance coverage or need legal guidance, don’t wait—contact us today. We’re ready to help you protect your future and get the compensation you deserve.